The Affordable Care Act (ACA), popularly known as Obamacare, is a significant piece of legislation that has provided quality healthcare to millions of Americans. With the marketplace plan open enrollment period now underway, it’s critical to understand how the ACA provides premium tax credits – or subsidies – that can help make health insurance more affordable.

Premium subsidies are available in every state through the exchange/marketplace and are designed to maintain pace with premiums so that they stay reasonable year after year. The American Rescue Plan (ARP) and the Inflation Reduction Act (IRA) have both extended some enhancements through 2025, lowering costs for eligible individuals and families who purchase coverage from an exchange/marketplace plan during open enrollment periods or qualify due to a qualifying life event outside of these times.

If you need health insurance but are concerned about your ability to pay for it, premium tax credits may be the answer! When you enroll in an approved plan through your state’s marketplace/exchange during open enrollment or if you encounter a qualifying life event outside of this time frame, you will receive considerable savings on monthly premiums. Consumers must take advantage of these chances before they expire at the end of 2025!

In comparison to other metal levels, pensive. However, it also implies that the benchmark plan (the second-lowest cost Silver plan) now has a significantly higher subsidy value than it had prior to 2017.

Subsidies are much more generous in most states in 2021 than they were in 2018, and in some cases significantly so. Many customers who qualify for premium tax credits or cost-sharing reductions (CSR) may find health insurance coverage through the marketplace significantly more inexpensive thanks to the additional assistance provided by both ARP and IRA.

If you’re shopping for health insurance this year, make sure you check to see if you qualify for any of these new subsidies, as well as any existing ones. It could result in significant savings on your monthly rates!

The good news is that qualifying individuals and families can choose from a variety of premium subsidies. The Advance Premium Tax Credit (APTC), which is available through the exchanges and helps cut monthly rates for those who qualify, is the most frequent type of premium subsidy. Additionally, there is a cost-sharing reduction (CSR) program that cuts out-of-pocket costs such as deductibles, copayments, and coinsurance for those with incomes up to 250% of the federal poverty line. Aside from these two programs, several states provide additional aid in paying premiums or reducing out-of-pocket payments, however they differ by state.

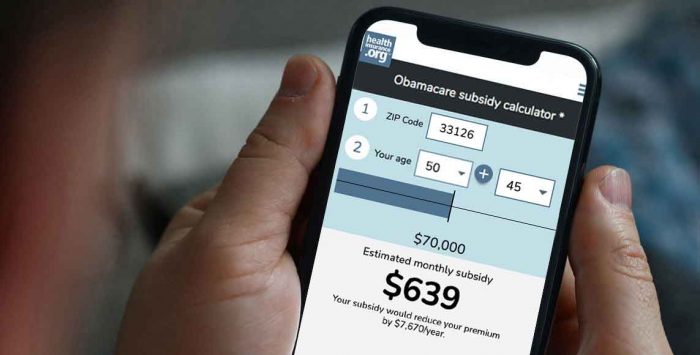

IIn addition to understanding what types of assistance may be available in their area, customers should be aware of how much they might receive if they qualify for a subsidy, as well as when those subsidies will take effect throughout open enrollment periods throughout 2022-2025). Depending on income and other characteristics (such as household size or age groups within families), qualifying individuals could have their post-subsidy premiums lowered by 30%-90%.

Overall, if you believe you may be qualified for a premium subsidy based on your income or other requirements listed above, it’s worth investigating! You may discover that coverage is more reasonable than ever before, thanks in large part to generous government aid programs developed particularly for this purpose!

Are you looking for inexpensive health insurance but aren’t sure if you qualify for an ACA subsidy? Because understanding the qualifications can be difficult, we’ve created this guide to help clarify who is qualified and what the conditions are.

In general, eligibility for an ACA subsidy is determined by your household income in relation to the federal poverty line. To qualify, your household must earn at least 100% of the federal poverty line or more than 138% in states that have extended Medicaid. From 2021 to 2025, there will be no cap on eligibility based on 400% of poverty; instead, it will be based solely on how much more than 8.5 percent of one’s income it would cost to purchase benchmark insurance plans offered through their state’s Marketplace exchange compared to their annual earnings before taxes (MAGI).

However, if your employer provides health benefits that are deemed “affordable” and give “minimum value,” you will be unable to get subsidies even if they are available in other instances – this is known as “the family glitch.” This means that while some members of a family may still qualify based on individual income alone, they will not receive any additional assistance because another member has employer-sponsored coverage through work, making them ineligible overall regardless of whether or not those same benefits meet all criteria set by law, such as affordability and minimum value standards established by ACA regulations.

Fortunately, there are some exceptions where people can still get subsidized coverage even if they have access at work, such as special enrollment periods triggered by employers not offering dependent children up until the age of 26 or when premiums exceed 9/10th (9%) pre-tax wages, among others outlined here: https://www.healthinsuranceprovidersdirectory….

Understanding these regulations may appear difficult at first, but knowing who qualifies makes researching healthcare options easier – especially when improvements such as abolishing caps on 400% earnings now apply!

You may have heard about the Affordable Care Act (ACA) and its requirement that companies provide affordable health insurance coverage with a minimum value as an employee. But how does this affect you? In short, if your employer provides a plan that meets these criteria – that is, it is both “affordable” and provides “minimum value” as defined by the ACA – they are providing a subsidy to their employees in the form of pre-tax health insurance benefits and an employer contribution to your premiums.

If your company does not provide such coverage, or if their plan does not fit either of these criteria, you can still obtain subsidized healthcare through one of the Obamacare exchanges. These plans offer access to quality care at cheaper costs based on income level; consumers who earn too much for Medicaid but do not qualify for work-based subsidies will be able to purchase plans at lower prices than those offered outside the exchanges. Those who are self-employed or unemployed may also find relief from excessive medical expenditures through exchange plans – albeit they should be aware that there are penalties associated with businesses providing inadequate coverage alternatives in order to avoid paying greater fines!

Regardless of where you land on this spectrum – employed with decent benefits or without any options – understanding how the ACA works will help secure access to quality healthcare while saving money on taxes and premiums! So spend some time now learning about all facets of Obamacare so that when open enrollment rolls around later this year (or whenever applicable), making informed selections regarding proper health care is easier than ever!