With the ACA Marketplace Open Enrollment period upon us, now is an ideal time to consider your health coverage options. Last year, the American Rescue Plan Act made private plans sold on the ACA marketplace far more affordable than it used to be and this improved premium subsidy will continue at least through 2025 thanks to the Inflation Reduction Act passed in August 2022.

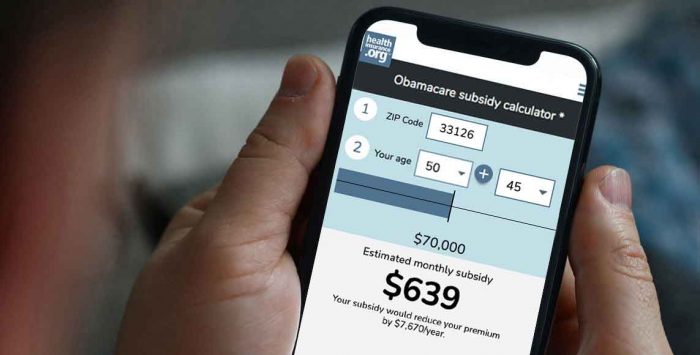

If you’re a citizen or legally present noncitizen under 65 years of age who can’t get health coverage through their employer or spouse’s employer and are not on disability Medicare, then you should definitely explore what is available in these exchanges. According to HealthCare.gov, which serves 33 states across America, four out of five people who enroll can find a plan for $10 per month or less (though many will choose plans that cost more).

This open enrollment period offers Americans a great opportunity for lower-cost healthcare coverage with better benefits – so don’t miss out! Be sure to take advantage of all information available online about different plan types and rates before making your decision so that you can make an informed choice about which one best meets your needs and budget constraints.

When it comes to selecting a health plan, your income matters. The Affordable Care Act (ACA) exchanges offer a range of plans and prices that vary depending on your household income. Generally speaking, the higher your income is, the more you’ll pay for coverage — ranging from zero in the lowest brackets to 8.5% of household income for benchmark Silver plans if you have an above-average salary or wages.

Before signing up for any health plan through one of these exchanges, there are two key points to keep in mind: firstly, small differences in projected incomes can have big impacts on available benefits; secondly – and this is important – when applying for ACA coverage you should report an estimate based on what you expect next year’s earnings will be rather than current ones since this gives some wiggle room when it comes time to renewing each year.

It’s also worth noting that while most people get their insurance through employers or government programs like Medicare or Medicaid—the ACA exchange offers another option with different levels of cost assistance depending upon how much money they make annually as well as other factors such as age and location which may affect premiums too so all options should be considered before making any decisions about choosing a policy..

In short: knowing where your estimated annual earnings fall into various categories helps ensure that no matter what kind of healthcare plan best suits both yours needs financially -and medically-you’ll always get exactly what works best according too individual circumstances.

For many people, the Affordable Care Act (ACA) can be a complicated and confusing process. But understanding the key income break points is essential for making sure you get the most out of your health care coverage.

The ACA application requires that you estimate your gross (before-tax) household income for the coming year, which will place you in one of several different brackets based on a percentage of federal poverty level (FPL). Depending on what bracket you’re in, how much money you pay and even what kind of coverage is available to you may change.

In 11 states*, those who estimate their household incomes below 100% FPL – or $13,590 per year for an individual person; $18,310 per two-person household; $23,030 per family with three members; or $27750 per family with four members – are not eligible to receive private plan coverage under this system. This unfortunate reality underscores why it’s so important to understand these key break points when applying through ACA so as not miss out on any potential benefits that could help lower costs while also providing quality healthcare services at an affordable rate!

When the Affordable Care Act (ACA) was first drafted, it made Medicaid available to most adults with an income below 138% of the Federal Poverty Level (FPL). However, in 2012 a Supreme Court ruling determined that states could not be forced to expand eligibility for Medicaid. As a result, many states have chosen not to expand and this has left many low-income individuals without access to any kind of health coverage. South Dakota recently voted by referendum in November 2020 for expansion which will begin July 2024.

Fortunately there is still help available for those living in non expansion states who make at least 100% FPL or more as they are eligible for subsidies through the marketplace created under ACA regulations. This discrepancy was originally seen as an inconsistency but ended up being beneficial since applicants making less than 138% FPL can still get some assistance when it comes to healthcare costs even if their state has chosen not participate in expansion efforts.

Low-income earners often experience uncertainty due fluctuating incomes and expenses so understanding your options when it comes affording health insurance can be confusing and overwhelming on top of everything else going on financially speaking . It’s important know what resources you may qualify based off your current financial situation so you don’t miss out on potential savings or support from government programs like Medicaid Expansion or Marketplace Subsidies .

In today’s economy, it is more important than ever to understand your health insurance options. One of the key eligibility thresholds for Medicaid in most states is 138% FPL (Federal Poverty Level). This means that if you are a single person with an income below $1,563 per month or a two-person household earning less than $2,106 monthly; or a family of three making under $2,648 each month; and finally if you have four people in your family and make less than $3191 each month – then you may qualify for Medicaid coverage.

This rule applies to 38 states** which have enacted the Affordable Care Act’s expansion of Medicaid eligibility criteria. In these states citizens as well as legally present noncitizens*** with incomes below 138% FPL can receive coverage through this program. It also means that those who experience sudden drops in their income due to job loss or other circumstances may become eligible even when they weren’t before – so long as their situation isn’t likely to improve quickly again soon after such an event occurs..

Medicaid provides great benefits at no cost (or minimal costs) compared to private health insurance plans available on the market place: there are usually no premiums charged at all by most state programs – only some charge small ones at higher tiers within this range – while out-of-pocket expenses tend not be too high either depending on what type of plan one chooses from within its offerings.. Therefore understanding how much one earns relative to this threshold can help them decide whether they should explore applying for coverage here rather than elsewhere!

When it comes to health insurance, there can be a lot of confusing options available. For those with income near the Medicaid eligibility threshold, they may prefer marketplace coverage for its wider choice of doctors and hospitals. While out-of-pocket costs are higher in the marketplace’s private plans than in Medicaid, they are comparatively low in Silver plans at low incomes due to cost sharing reduction (CSR) subsidies that attach to Silver plans for lower income enrollees. In fact, two cheapest Silver plan options could even be free up until 150% FPL (Federal Poverty Level).

For those who have suffered a sudden loss of income and find themselves near or below this threshold level may qualify either for Medicaid or Marketplace coverage depending on their current monthly vs annual estimated incomes respectively. The HealthCare website provides an application section where you can estimate total annual incomes when your current monthly is either too high or too low so as to determine which option would best suit your needs given your financial situation at present time.

Overall it’s important that you understand all the different healthcare options available so as not get overwhelmed by them but instead make an informed decision about what works best for you financially while still providing adequate care should any medical emergency arise unexpectedly down the line!

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!