Insurance companies use risk-based pricing to determine the cost of coverage for their customers. By assessing specific risk factors and likelihood of submitting a claim, insurers can offer more affordable rates on policies while still providing adequate protection. This means that policyholders with favorable risk profiles will pay lower premiums than those who have higher risks associated with them.

However, there are potential complications when using certain rating factors in determining insurance prices – such as credit scores, home ownership status or motor vehicle records – which could lead to “proxy discrimination” and other unfair practices that may be perceived as discriminatory against certain groups or individuals. As a result, it is important for insurers to take into account all applicable laws and regulations when setting rates based on these criteria so they remain compliant and equitable in their pricing strategies.

Overall, setting insurance prices based on the level of assumed risk is an essential part of providing fair coverage at reasonable costs for all types of policyholders across different demographics; however it must be done responsibly within legal boundaries to ensure no one group is unfairly disadvantaged by this process.

In recent years, however, there has been an increase in concerns about proxy discrimination. This occurs when people of color living in urban neighborhoods are charged more than their suburban neighbors for the same coverage and when gender is used as a rating factor. These practices can lead to higher costs for those who may already be struggling financially due to systemic inequality or other factors.

It’s important that insurers take steps to ensure they are not engaging in any form of unfair discrimination based on race or gender—or any other non-risk related characteristic—when setting rates and reserving funds needed to pay claims. In order for this process to work effectively, it requires actuaries and data scientists working together with regulators and consumer advocates so that pricing models accurately reflect risk while avoiding discriminatory outcomes at the same time.

At Triple-I we believe that fairness should always be at the heart of insurance pricing decisions – no matter what part of town you live in – if we want everyone have access affordable protection from financial loss due unforeseen events like accidents or natural disasters . We also recognize our responsibility as an industry leader by providing guidance on best practices around risk assessment and helping consumers understand how these processes work so they know what types of questions they should ask their insurer before buying a policy.

In today’s diverse society, there is no place for discrimination in the insurance marketplace. Whether it be based on race, religion, ethnicity or sexual orientation – any factor that doesn’t directly affect the risk being insured should not be taken into account when setting premium rates. To do so would simply be bad business and fundamentally unfair.

Insurers have been criticized for using credit-based insurance scores, geography and motor vehicle records to set home and car insurance premiums as some claim this can lead to ‘proxy discrimination’ with people of color sometimes paying more than their neighbors for the same coverage. Insurers counter that these tools reliably predict claims which helps them match premiums with risks – preventing lower-risk policyholders from subsidizing higher-risk ones.

It is understandable why public confusion exists around how insurers rate policies as actuaries must distinguish causal relationships from correlations when determining an individual’s rate classifications – a complex process which could potentially result in someone unfairly receiving a higher premium due to factors outside of their control such as where they live or what type of car they drive rather than actual risk levels associated with insuring them . This is why it’s important that insurers use transparent rating practices which are fair and equitable across all consumers regardless of demographics while still ensuring adequate protection against risks posed by individuals seeking coverage .

At its core , fairness should always remain at front center stage when evaluating potential customers in order to ensure everyone has access to affordable quality coverage without prejudice or bias towards any group – something we can all agree upon!

Public confusion around insurance rating is understandable. After all, the models used to determine insurance rates are complex and require actuaries to distinguish causal relationships from superficial correlations in order to appropriately align insurers’ prices with the risks they cover. If done incorrectly, this could compromise an insurer’s ability to keep their promises of paying policyholder claims.

What’s more, insurers have a legal obligation under anti-discrimination rules in 50-plus U.S jurisdictions that they must comply with when determining premiums for customers – making it even more difficult for them (and us) when trying make sense of how our premiums are calculated!

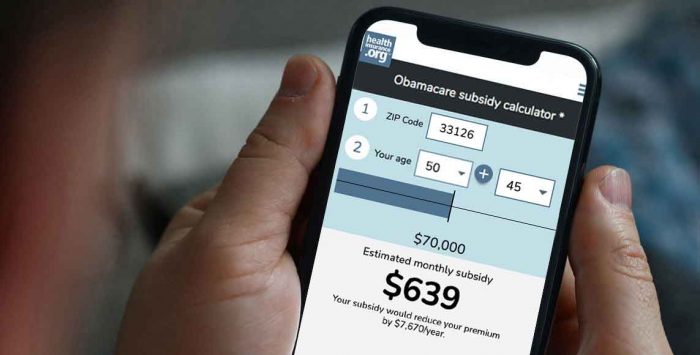

To help alleviate some of this confusion and ensure everyone has access fair pricing on their policies, many states now require that companies provide rate transparency by publishing detailed information about how certain factors can affect your premium cost – such as age or gender – so you know what you’re being charged for exactly before signing up for coverage. Additionally there are tools available online which allow users compare different plans side by side so they can make informed decisions about which plan best suits their needs at the best price possible – further helping consumers understand why one product may be priced higher than another despite offering similar levels of protection or coverage benefits .

In short: Insurance ratings may seem complicated but understanding them doesn’t have too! With increased rate transparency laws and comparison tools out there today it’s easier than ever before stay informed on your options while ensuring you get quality protection at a fair price point no matter who you choose as an insurer.

Pricing insurance can be a tricky business. Insurers have to balance the need for fair and equitable coverage with the realities of risk, cost, and profit margins. It’s a high-wire act that requires careful consideration of all these factors in order to provide adequate protection without making policies unaffordable or leaving customers underinsured.

As regulations change over time – as well as society’s understanding of discrimination – insurers must stay abreast of new definitions and interpretations when it comes to pricing their products fairly across different demographics or groups. This is especially true in cases where there are potential disparities between prices charged based on gender, race, religion or other protected classes; such practices may constitute illegal discrimination if they are not carefully monitored by insurers and regulators alike.

The good news is that many insurers understand this responsibility—and take it seriously—in order to ensure fairness for their customers while also protecting their own bottom line from unnecessary risk exposure due to discriminatory practices. By working closely with policymakers at every level—from local governments up through federal agencies like the Department of Justice (DOJ) —insurers can help shape public opinion about how pricing should be conducted responsibly so everyone has access affordable yet comprehensive coverage options regardless who they are or what kind policyholder they represent .

In short: insurance pricing requires an astute eye but one which takes into account more than just dollars and cents; rather ,it needs consider social values too if companies want remain competitive while still being compliant with applicable laws regarding equality within industry standards..